Create Your Business (For Canadians)

This is a doc for those who want to start a business in Canada and have a guidance on where to start and tips and tricks

About

Businesses as an entity have been the cornerstone of the economy. Creating a business comes with many challenges but will be rewarding if successful (big if here). With that being said and you still want to peruse it, read on and good luck!

🚧 Warning: 20% of businesses within the first year, 30% by year 2 and 50% by the five year mark according to sources

Types of businesses

There are 3 main types of businesses, sole proprietorships, partnerships, and corporations. I will give a very short run down of these three types

sole proprietorship - great for just starting out with one person but should only be used for very small operations

partnership - same as sole proprietorships but with a partner instead

corporation - a legal entity that is distinct from the owner. This means legal and financial consequences (ie debt) will not directly impact the owner(s) of the company [this is what makes corporations fundamentally different from the previous two]

For this doc we will mainly focus on corporations but some sections still apply to the others (like taxes)

Starting a business

The first step to start a business. This does not have to be official but you need to think of a general idea of the business. This should be a precise goal and should be reflected in a 1 sentence statement most people refer to as the mission statement.

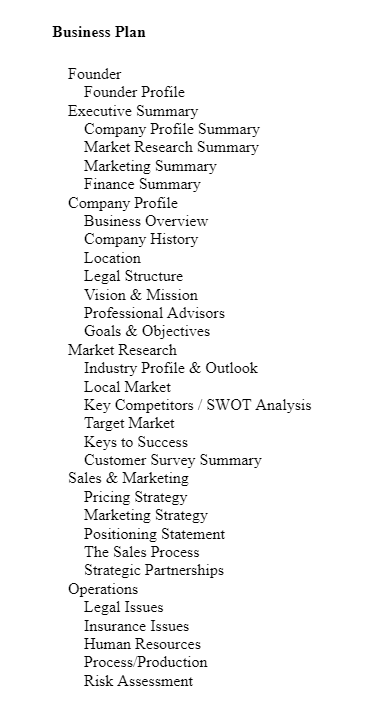

✨ Tip: if you want to be extra prepared, write a doc with market analysis, target market, timeline, cost analysis, etc. Most people refer to this as the business plan. See below for an example of a plan’s overview:

Create a business

The first step to legally creating a business is to register it with the government. There are two options here, federal and provincial corporations. The differences between these are extremely small but provincial tends to be more expensive and less protection outside of the province so I’d recommend registering federally. To do this head over to the government website for registration and click on the incorporate button. Follow the steps and you will officially be a business afterwords. In doing so, you also get a business ID to open a bank account! In addition if you choose to register your name, no one else in the province will be able to claim the same name. Most of the documentation required is generated for you but you must keep these documents as they are the founding documents although you can make amendments for a fee.

After registering your corporation federally, you must register your federal corporation in your home province/jurisdiction as an extra-provincial registration unless you already did so in the federal website on the last step. This jurisdiction should have a valid (mailing) address that you have access to. You may also need to do another name search provincially 😔.

✨ Tip: make sure you do a quick Google search for your company name to make sure it’s not conflicting with anything and to register your domain

⚠ Warning: Registering a corporation with the province of Alberta requires a physical trip to a office because it cannot be done online at the time of writing in 2022 🙄

🛑 Alert: When conducting business in a province you are required to register as an extra-provincial, however generally this does not include single client if you are consulting or servicing or it is temporary. In addition, depending on your minicipality, you may need to buy a business license from the city, even if you are purely online (ie Regina, SK)

📚 Resource: follow this YouTube tutorial to fill out a federal incorporation online

Finance

This is not financial advice but seek a financial advisor before making any important decisions. Otherwise just keep track of all expenses, revenues, and the such in a spreadsheet or financial tracking software. In addition keep records for all transactions (ie memos, receipts, or bills) related to the business such that you can go back to them or if you are audited by the government

✨ Tip: It is highly recommended to keep a month over month balance sheet and financial journal. You can find many templates for them online

📚 Resource: See the general costs in this YouTube Video

Legal

This is not legal advice but you should seek legal advice from a trusted source. With that said, here is my non-legal advice. Create a contract for yourself as the sole owner and employee. This will not make you legally liable from the company’s concerns. In addition to codifying the company there needs to be an annual board meeting, even if you are the sole shareholder.

Taxes

Taxes are one of the highest expenses for businesses. However businesses can take advantage of many tax write offs since revenue - expenses = profit. Also note when you are paying taxes, you will need to pay provincial and federal tax but note that small businesses have reduced rates (in fact some provincial small biz taxes are 0%!).

See the CRA website for a full list of tax deductible expenses

✨ Tip: It is also recommended to find a tax accountant or consult/firm to help you fill returns (this will be a tax write off 😎)

License

Contents: